BYD Sealion 7 Premium

$50,162

Income salary packaging, also known as salary sacrifice, is a financial arrangement that allows employees to allocate a portion of their pre-tax income towards approved benefits or expenses.

This arrangement reduces their taxable income, potentially leading to tax savings. Commonly included benefits are superannuation contributions, vehicle leases, electronic devices and workplace-related expenses.

Employers offer salary packaging as a way to enhance employee remuneration, improve job satisfaction, and attract top talent, while employees enjoy greater financial flexibility and savings.

Salary Packaging Australia (S.P.A.) specialises in guiding organisations and employees through this process. We ensure transparency, compliance and accuracy throughout the process to maximise the benefits for all parties involved.

The types of benefits and the amount you can include in your salary package depends on your employer and the industry in which you work. There are many ways to save on everyday living expenses and have more left over for personal expenses. Here is an overview of what might be possible:

Known as a Novated Lease, you can lease vehicles, including electric options, to make vehicle ownership and running costs more affordable.

FIFO workers can benefit from options tailored to remote work, such as travel expenses and accommodation.

Cover approved insurance premiums, providing financial protection while reducing taxable income.

Living Away From Home Allowance to help cover the costs of living away from your usual residence.

Relocation costs, such as moving expenses and temporary accommodation, to ease the financial burden of relocating for work.

Essentials like groceries, utility bills, and school fees can be salary packaged, freeing up disposable income.

Tools and equipment required for your job can be salary packaged, ensuring you have the resources needed for success.

Dine out or entertain with clients and colleagues using pre-tax income, leveraging salary packaging for meal and entertainment expenses.

Salary packaging your rent helps manage housing costs efficiently, especially for employees living in eligible accommodation.

Tuition fees and study-related expenses can be salary packaged, helping you invest in further education while reducing taxable income.

Professional memberships and subscriptions can be salary packaged, supporting career development and compliance with industry requirements.

Some employers offer salary packaging for mortgage repayments, allowing you to reduce your taxable income while paying off your home.

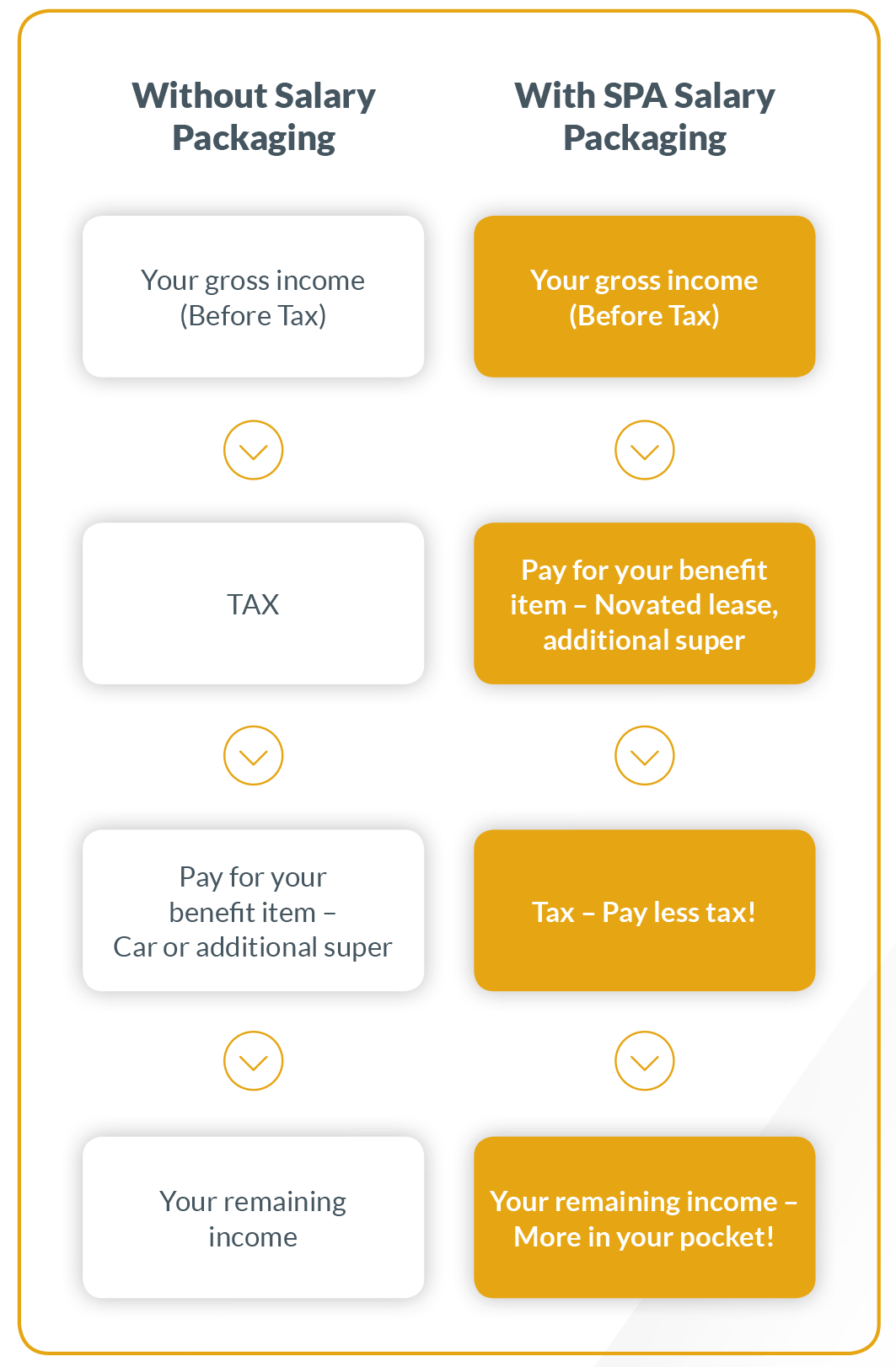

To salary package means making a financial arrangement that allows you to pay for approved benefit items using your pre-tax salary. This means these expenses are deducted from your income before income tax is applied, leaving you with less taxable income and enabling you to pay less income tax overall.

By leveraging salary packaging, you restructure your income to maximise disposable income while taking advantage of significant tax benefits. Everyday expenses such as rent, living costs, or work-related items can be included, helping you manage your finances more efficiently.

When you commence salary packaging, your employer’s payroll department transfers the nominated pre-tax funds to Salary Packaging Australia (S.P.A.) for disbursement to cover your chosen benefit items.

At Salary Packaging Australia, we specialise in providing compliant and technically strong novated leasing and salary packaging services to employers and employees across the country.

We pride ourselves on delivering transparent and accurate services, ensuring that both employers and employees experience a positive process. Our expert team handles every aspect of salary packaging, from setup to ongoing management, making it a hassle-free solution for everyone involved.

By partnering with Salary Packaging Australia as your novated lease and salary packaging provider, employers can enhance their workplace offerings while employees enjoy the financial benefits of salary packaging – a true ‘win-win’ for all.

Trusted ExpertiseWith years of experience as a leading employee benefits provider, S.P.A. has helped countless Australians maximise their income through tailored salary packaging solutions. |

Tax BenefitsWith over 20 years experience, S.P.A. can help you take advantage of paying for certain expenses with pre-tax dollars, reducing your taxable income and increasing your take-home pay. |

Simple and Convenient ClaimsOur user-friendly platform ensures you can make claims quickly and easily, without the hassle of paperwork. |

Flexible Solutions for Every LifestyleWhether it’s managing living expenses, funding education, or securing a new car, S.P.A. offers versatile salary packaging options to suit your needs. |

Dedicated SupportSalary packaging can seem complex, but S.P.A. provides clear guidance and exceptional customer service, making the process smooth and stress-free. |

Affordable Vehicle OptionsAccess great deals on vehicles, including electric vehicles, while we handle everything – from sourcing the car to paperwork and budgeting. |

When an employer offers novated leasing or salary packaging, it can lift the appeal of the company to future job candidates.

As a flexible, compliant and trusted salary packaging provider, we can save your employees thousands in tax, and make your organisation even more desirable to top talent.

Leverage our extensive expertise in the mining and resources sector to attract, recruit, and retain top talent. Offer competitive benefit packages that enable employees to reduce their tax liabilities and enjoy higher take-home pay.

Provide compelling benefit packages that help education sector employees minimise their tax obligations while maximising their take-home pay and enhancing job satisfaction.

Secure, engage, and retain top-tier talent in the private sector. Offer tailored benefit packages that reduce employees’ tax burdens and ensure greater financial satisfaction.

We have a long track record of implementing and servicing compliant, accurate and efficient salary packaging solutions for many Local, State and Territory Government organisations including being panelists for the QLD, ACT, WA and NT Government.

Not-for-profit organisations can attract and retain skilled professionals with tailored benefit packages, enhancing the appeal of working for your NFP or charity.

The Electric Vehicle (EV) market is now more affordable with the Electric Car Discount Bill 2022, which exempts eligible EVs from Fringe Benefits Tax (FBT). This makes EV ownership more accessible, driving a shift toward a sustainable future.

Thousands of Australian workers benefit from our industry-leading salary packaging solutions to save money and pay less tax.

Wondering how much salary packaging a car could save you? Check out our calculators for an estimate on your potential savings, or get in touch today!