Discover how you could save with Salary Packaging Australia’s novated car leasing options. Our dealer network means you will get exceptional service in sourcing your new or used car, as well as huge price discounts on novated lease vehicles.

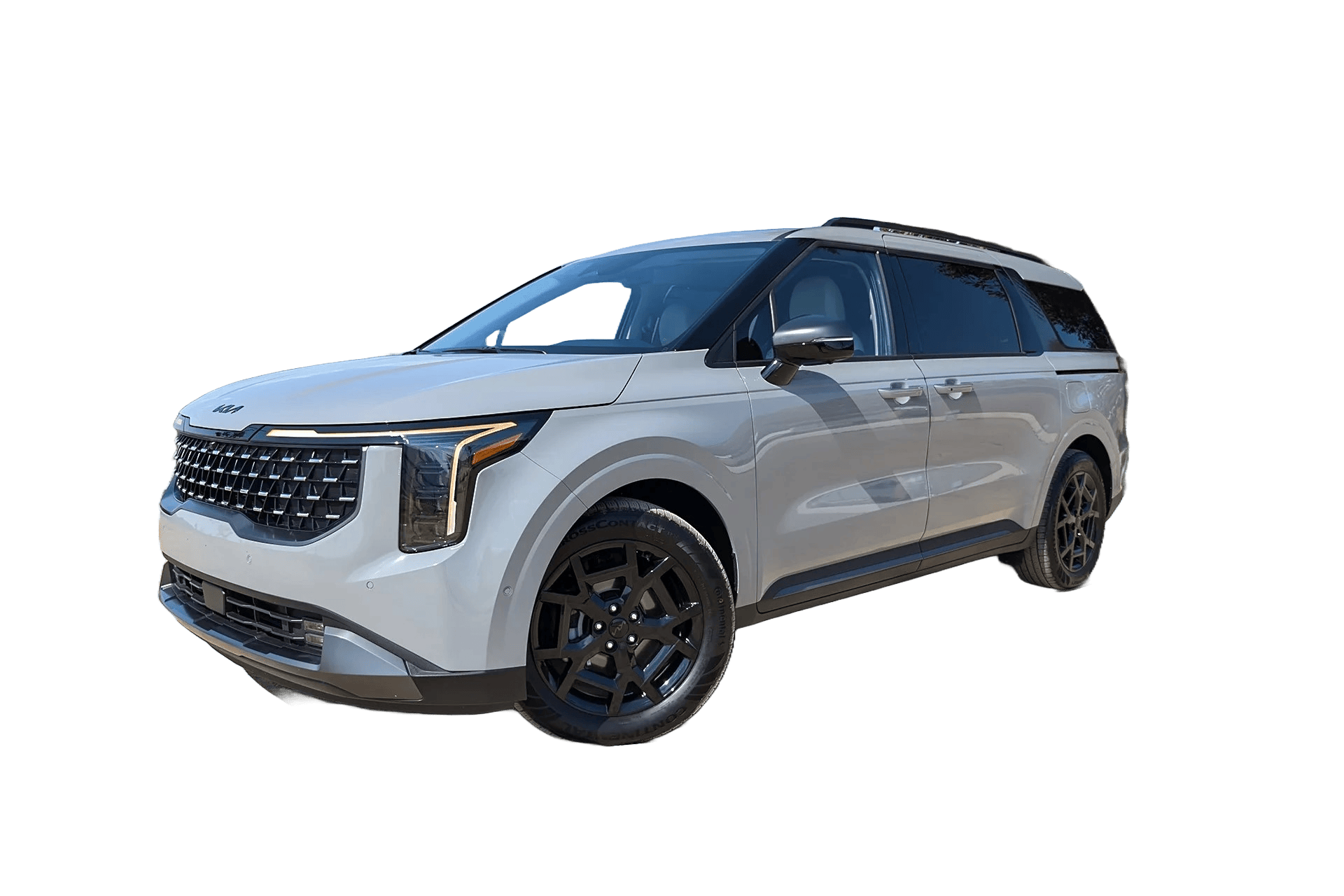

Current Deals On Novated Lease Vehicles

Select your vehicle type

EVs

Small

Mid

SUV

Large

4X4

PHEV

Novated Car Lease Deals FAQs

How does a novated lease work?

A novated lease is a salary packaging arrangement where an employer deducts the cost of a used or new car and its associated running costs from your pre- and post-tax salary. This arrangement can provide significant tax savings and streamline budgeting for your car expenses. Click here to learn more about novated lease benefits.

What costs are included in novated lease deals?

A novated lease deal typically covers vehicle finance, registration, comprehensive motor vehicle insurance, fuel, maintenance and servicing. Car running costs are also included in the novated lease arrangement to help you manage the ongoing expenses of vehicle ownership with fixed lease payments.

How are novated lease deals calculated?

A novated lease is calculated based on the vehicle purchase price, lease term, residual percentage outlined by ATO guidelines, and estimated running costs. Factors like your pre-tax salary, individual circumstances and the employee contribution method (ECM) can affect the final weekly cost.

What tax savings can I expect with novated lease vehicles?

By salary sacrificing through a novated lease, you reduce your taxable income, leading to potential income tax savings. GST savings are also applicable on the vehicle purchase price and ongoing running costs. For eligible electric vehicles, Fringe Benefits Tax (FBT) exemptions may further enhance your savings estimate.

What is the employee contribution method (ECM), and how does it compare?

The employee contribution method (ECM) means paying some of your lease costs, like fuel or maintenance, using your post-tax salary. This helps lower the amount of Fringe Benefits Tax (FBT) you need to pay, potentially increasing your overall savings. The benefits of ECM depend on your personal circumstances, including your gross annual salary and the residual percentage value of the car at the end of the lease.

Are electric vehicles eligible for novated lease deals?

Yes, eligible electric vehicles, including plug-in hybrids* like the BYD Sealion 6 or extended-range EVs like the Tesla Model series, may qualify for novated lease deals. FBT exemption applies to certain EVs that meet the following criteria, such as staying under the luxury car tax threshold.

*PHEV eligibility ends on 31 March 2025

Can I get a novated lease deal for any vehicle?

Novated lease deals are available for a variety of passenger vehicles, such as the Mitsubishi Outlander, Mazda CX series, Ford Ranger, MG ZS, and Isuzu MU. However, commercial vehicles, including vans and minibuses, are not eligible for novated leasing. The pricing, range and availability of vehicles depend on your lease term and personal preferences.

What happens at the end of the lease term?

At the end of the lease, you can choose to pay the residual value (as outlined by the assumed residual percentage), refinance, or trade in the vehicle. The residual percentage outlined in the novated lease agreement adheres to ATO guidelines.

Should I seek independent financial advice before committing to a novated lease?

At S.P.A., we are proud to provide a transparent and accurate service for all our novated lease options. We highly encourage every applicant to seek independent financial advice to ensure the novated lease deal suits your individual circumstances, including income tax implications and potential tax savings. Understanding the savings estimate based on your situation can help guide your decision-making process.

Can running costs change during the lease?

Budgeted running costs, such as registration, re-registration, servicing, and fuel, are estimated at the start of the lease. These costs may change due to factors like on-road costs, inflation, or changes in fuel prices. While these variable costs can fluctuate, your fixed repayment amount remains consistent throughout the lease term. If running costs increase significantly, you may wish to adjust your budget or make additional payments to cover any shortfalls.

How can I get a vehicle quote for a novated lease with S.P.A.?

Contact Salary Packaging Australia to request a vehicle quote. We will provide details on vehicle pricing, GST saving benefits, and a detailed savings estimate for your novated lease deal.

Is comprehensive insurance, maintenance and registration included in a novated lease?

Yes, comprehensive insurance, maintenance, and registration can be included in a fully maintained novated lease package. This provides peace of mind by covering essential vehicle-related costs in one streamlined arrangement.

With a fully maintained package, you receive:

- Comprehensive Insurance: Your vehicle is protected against accidents, theft, and other potential risks.

- Maintenance: Regular servicing, repairs, and replacements, such as tires and batteries, are included, ensuring your car stays in optimal condition.

- Registration: Annual registration fees are managed as part of the lease, saving you the hassle of separate payments.

By bundling these expenses into a novated lease, you reduce unexpected out-of-pocket costs and simplify budgeting throughout the lease term.

Reach out to S.P.A. for tailored advice and support with your novated lease deal!

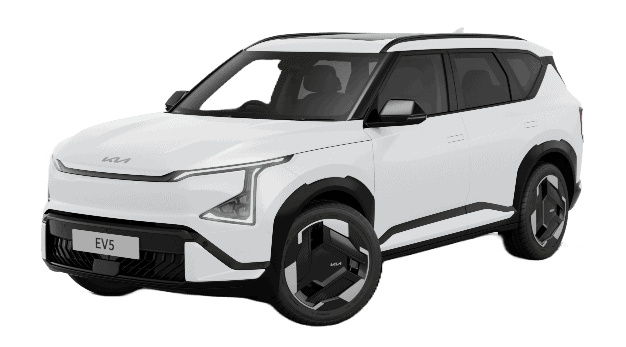

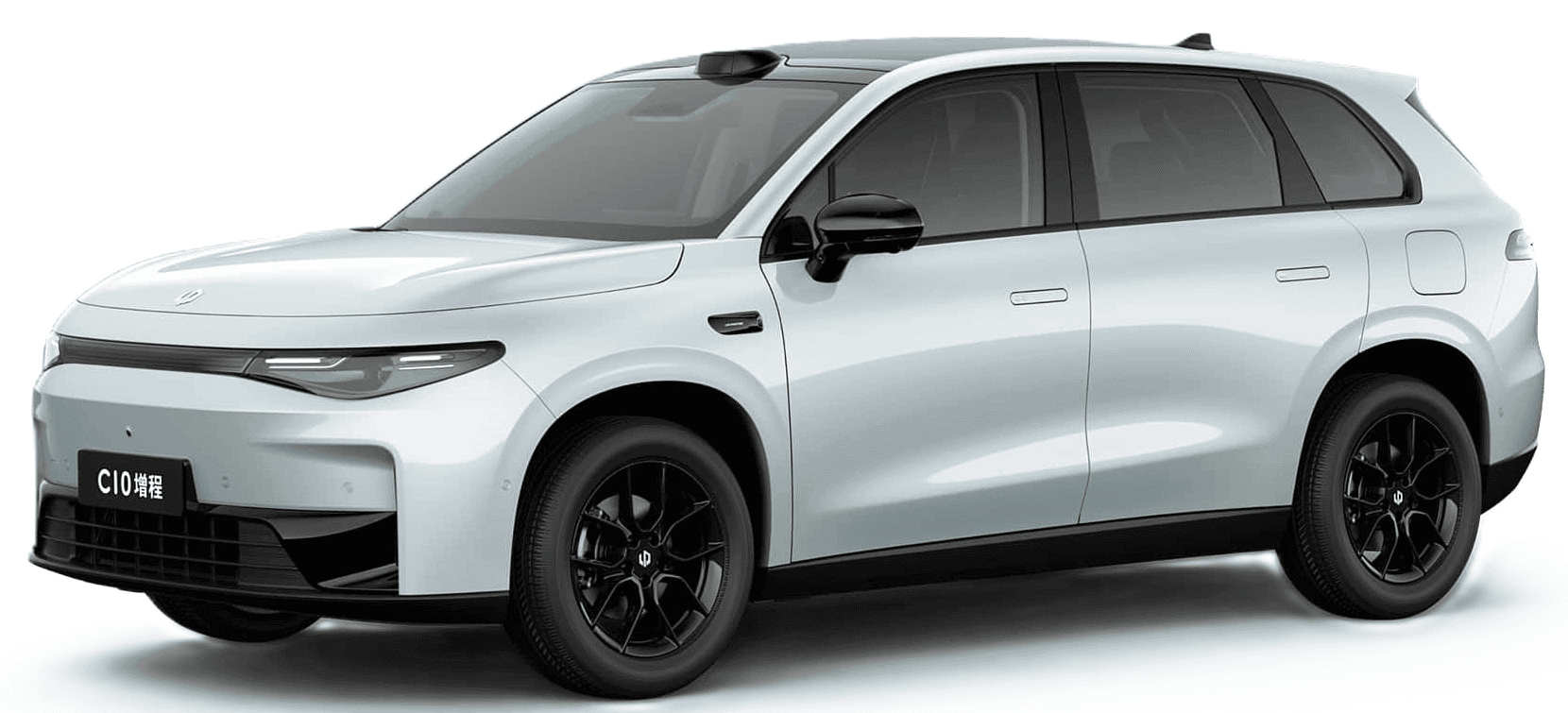

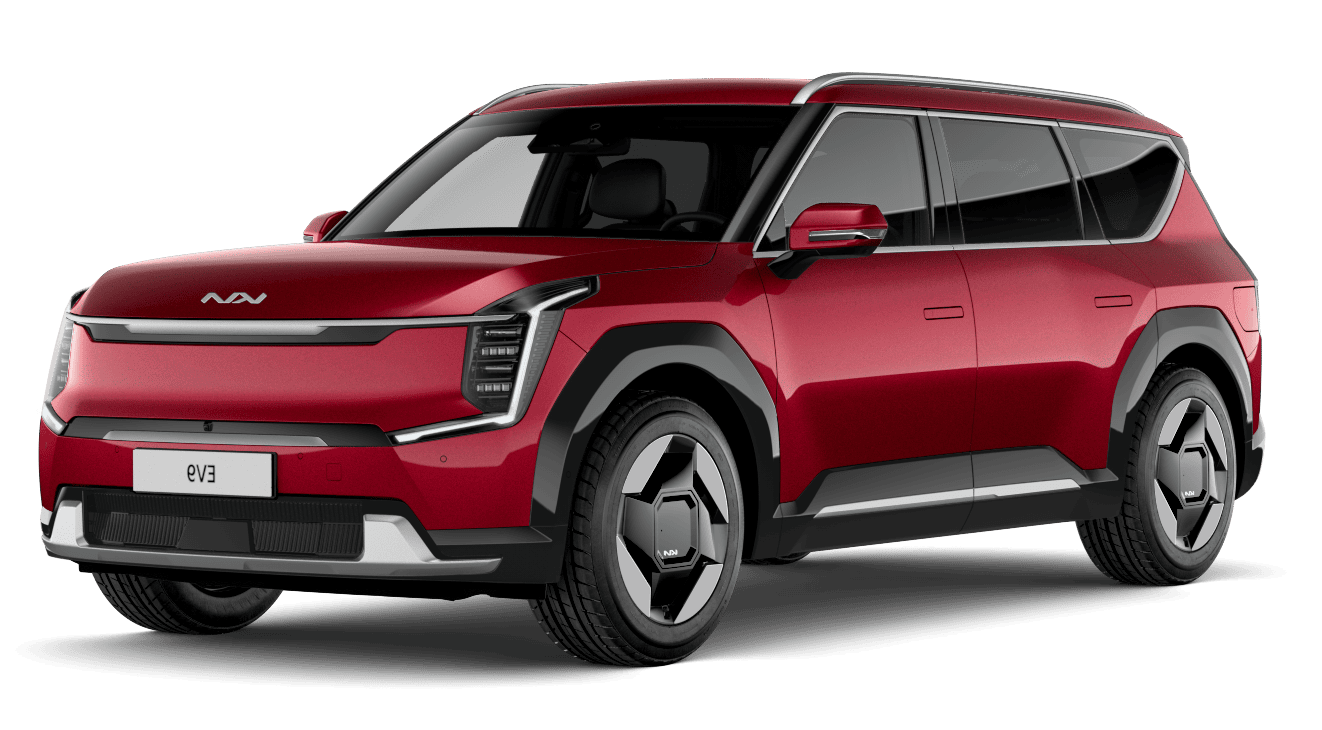

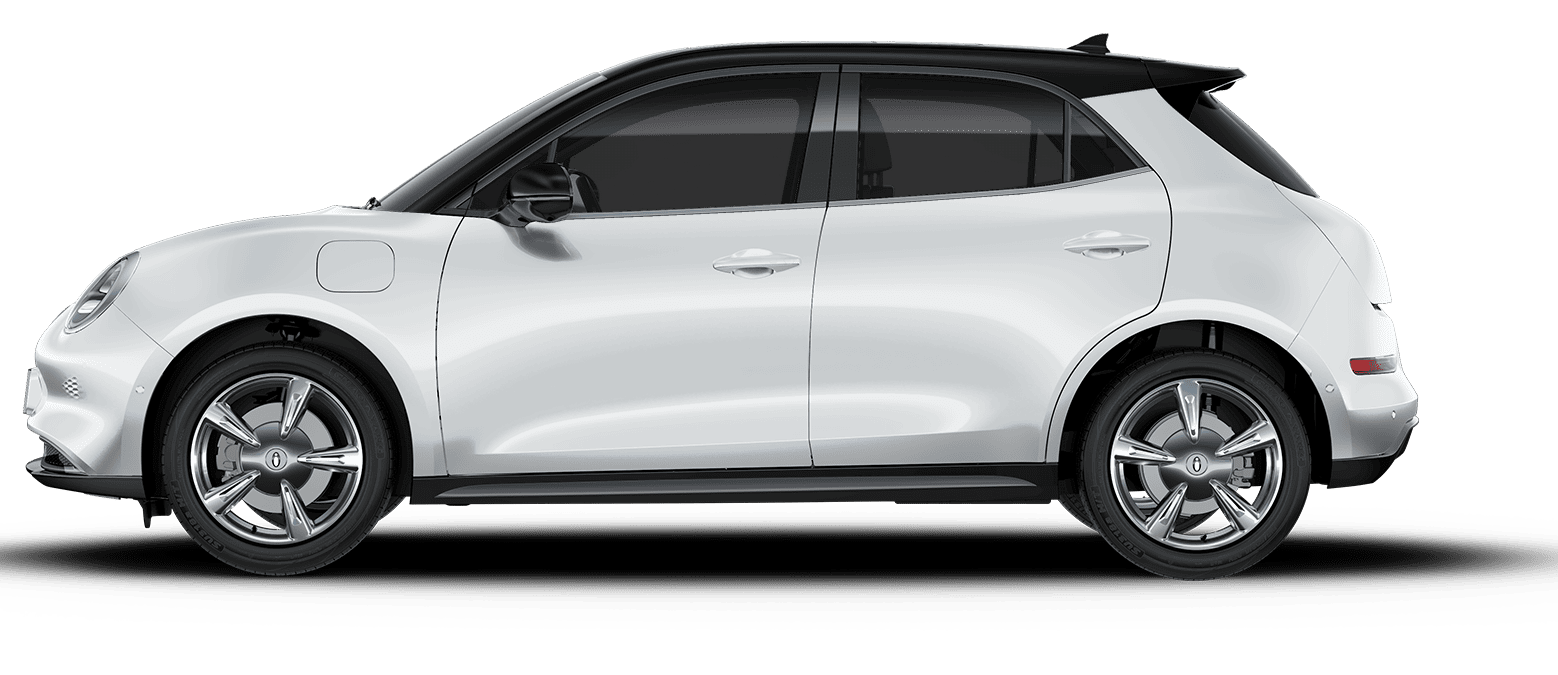

* All benefit examples based on a 60 months terms driving 15,000 km per annum on a $85,000 annual salary. Prices excluding GST under novated lease and images are for display purposes only. Vehicles subject to availability. Pricing is based upon supply of motor vehicle in South-east QLD. Vehicle pricing may be subject to change without notice. Pricing may vary dependant on the exact location and State of purchase and are based on PAYG income tax rates as at 1/07/2024.

The salary packaging of motor vehicles works for you by substituting a taxable benefit with a non-taxable benefit. The above cost figures represent the estimated impact on your take home pay taking into account those tax benefits based on the assumptions outlined. You should obtain independent financial advice taking into account your personal circumstances before you rely on these figures. Salary Packaging Australia Pty Ltd ABN 53 0 0 9 643 485

Need help or want to discuss?

Contact our team directly, we are here to help

Need help or want to discuss?

Contact our team, we are here to help

Address

Brisbane Office:

1/10 Hudson Road,

Albion QLD 4010

Darwin Office:

Ground Floor, 39 Woods Street,

Darwin NT 0810

Adelaide Office:

272 Glen Osmond Road,

Fullarton SA 5063

Mackay Office:

2D/52 MacAlister St,

Mackay QLD 4740

Benefits

Quick Links

PHONE

enquiries@salpacaus.com.au

Opening Hours

8.00am – 5pm Monday to Friday

Subscribe to our Newsletter

Receive our monthly vehicle deals and informative blogs to your mailbox. View our Privacy Policy here

We acknowledge the Turrbal and Jagera people of the Yuggera Nation, Traditional Custodians of the country on which we gather. We recognise their continuing connection to the land and waters, and thank them for protecting this coastline and its ecosystems since time immemorial. We pay our respects to Elders past, present and emerging, and extend that respect to all First Nations people present today.

Not now, not ever. Together

We do not tolerate inequality and domestic and family violence. Salary Packaging Australia pledges to work toward a Queensland where everyone is equal and free from violence. Salary Packaging Australia commits to playing our role, working within our organisation and in partnership with others to raise awareness, improve prevention and provide practical assistance to end domestic and family violence. Salary Packaging Australia recognises as leaders in the corporate and community sectors we have a vital role to play and we agree to use our internal and external and formal and information networks to activate others to join in this shared objective of keeping everyone safe from violence.

© 2026 Salary Packaging Australia.